Content:

Why PayPal | Features | Pricing | Success Story

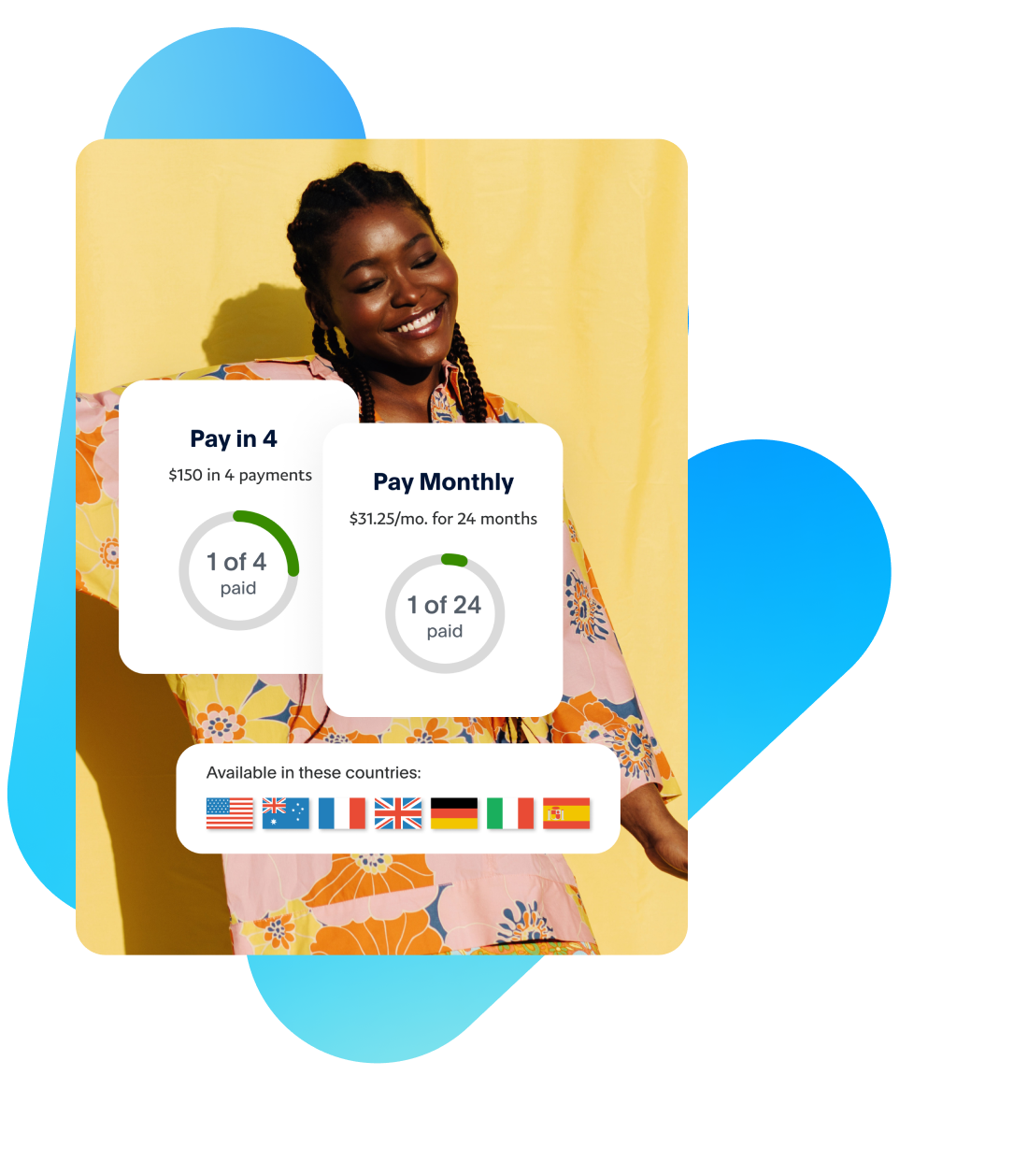

Let customers pay in installments with Pay in 4 and Pay Monthly3 — while you get paid up front at no extra cost to you. Promoting buy now, pay later messaging on your site at key points of the shopping journey can help boost average order value (AOV)4 and encourage customers to buy more5 — and more often.6

39% increase in cart sizes when Pay Later options are promoted.4

Venmo is already part of PayPal Checkout — at no additional cost. Gain appeal to Venmo customers who are active spenders7 with more spending power.8 And help bring more visibility to your business with a payment method customers can easily share.

2x Venmo users spend 2x more.9

With country-specific payment methods, you can reach international customers while making your business feel local. Build trust and include options like Payment Upon Invoice (PUI) — a local payment option available only for purchases completed in Germany.

Add all major debit and credit cards to your all-in-one solution. It’s easy to manage and we handle the processing.

✔️PayPal Checkout: PayPal, Venmo, Pay Later, and more13

✔️Credit and debit card payments processed right on your site

✔️Local payment methods used around the world14

✔️Funds credit immediately into your PayPal business account while payments process

✔️It's easy to add and complements new and existing checkout solutions

✔️Save customer billing and shipping info for fast, convenient checkout

✔️Mobile-friendly so customers can easily shop on any device

✔️Drive authorization rates, reduce declines, and help capture every sale

✔️Track all your transactions from one dashboard

✔️Optional Chargeback Protection to help reduce fraud-related costs15

✔️PayPal helps you handle the risk of fraudulent purchases

✔️AI-powered technology monitors all transactions

✔️PayPal Seller Protection on eligible transactions safeguards PayPal Checkout16

✔️PayPal solutions help you meet global compliance standards

✔️Additional security offers insights with Fraud Protection on eligible transactions17

No monthly or setup fees. Only pay when you get paid.19

|

Online Credit and Debit Cards (without Chargeback Protection20) |

2.59% + $0.49 |

|

Online Credit and Debit Cards (with Chargeback Protection20) |

2.99% + $0.49 |

|

PayPal Payments21 |

3.49% + $0.49 |

|

In-person Credit and Debit Card Payments with PayPal Zettle22 |

2.29% + $0.09 |

|

In-person PayPal and Venmo QR code Payments Above $1023 |

1.90% + $0.10 |

**US domestic fees; fees vary by country and are subject to change.

If you are a Shopware 6 customer with a self-hosted store, upgrade to PayPal Checkout now.

If you are a Shopware 5 customer, migrate to Shopware 6 before upgrading to PayPal Checkout.

1An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39 (among PayPal users, n=682).

2Nielsen Attitudinal Survey of 2,801 consumers who had made a recent (past 2 weeks) purchase across any of 8 verticals (e.g. health & beauty, fashion, groceries) in June 2020.

3About Pay in 4: Loans to CA residents are made or arranged pursuant to a CA Financing Law License. PayPal, Inc. is a GA Installment Lender Licensee, NMLS #910457. RI Small Loan Lender Licensee.

Pay Monthly is subject to consumer credit approval. 9.99 - 29.99% APR based on the customer's creditworthiness. The lender for Pay Monthly is WebBank. PayPal, Inc. (NMLS #910457): CT Small Loan Licensee. RI Loan Broker Licensee. VT Loan Solicitation Licensee.

4PayPal's Buy Now, Pay Later is boosting merchant's conversion rates and increasing cart sizes by 39%. PayPal Q2 Earnings-2021.

580% of BNPL users agree that seeing a BNPL message while browsing gives them the ability to spend more. An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39. (Among BNPL Users, n= 357)

674% of BNPL users are more likely to shop at a merchant again if they offer a buy now, pay later option. TRC online survey commissioned by PayPal in April 2021 involving 1000 US consumers ages 18+ (among BNPL users, n=282).

7Focus Vision, Commissioned by PayPal. October 2020. The Venmo Behavior Study explores valuable insights for merchants to consider to reach a broader audience including 2,217 Venmo customers' financial habits, purchasing behaviors and perceptions of Venmo as a payments tool.

850% of Venmo users are more likely to have a high household income than online payment users overall. (Page 8). Source: Statista Global Consumer Survey as on July 2020. The target population are internet users in U.S. between 18 and 64 years of age.

9Edison Trends, commissioned by PayPal, April 2020 to March 2021. Edison Trends conducted a behavioural panel of email receipts from 306,939 US consumers and 3.4+ M purchases at a vertical level between Pay with Venmo and Non-Venmo users during a 12-month period.

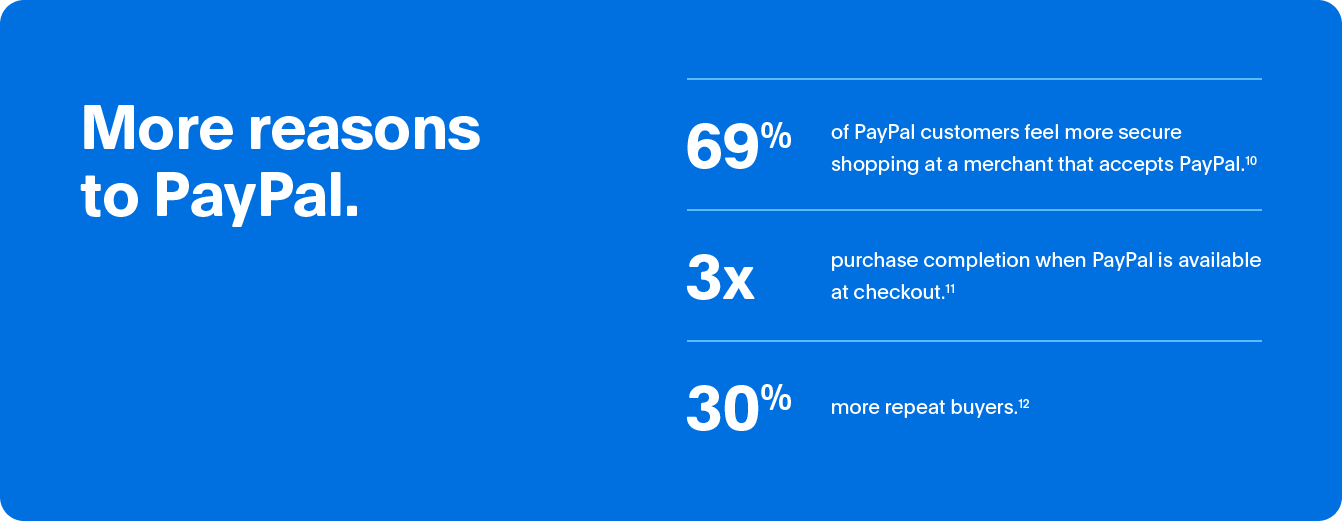

10An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39. (Among PayPal users, n=682)

11Nielsen, Commissioned by PayPal, July 2020 to September 2020 of 15,144 US consumers to understand and measure the impact that PayPal has for US-based LE merchants across different verticals.

12Nielson, Commissioned by PayPal, Nielsen Media Behavioural Panel of USA with SMB desktop purchases from 7,317 consumers who are PayPal users from April 2020 to March 2021.

13Venmo is available only in the US.

14Availability may vary depending on merchant’s integration method and geographic location

15Chargebacks that are not related to fraud or item not received (INR), such as broken item, significantly not as described (SNAD), refund not processed, and duplicate charge, are not protected by Chargeback Protection. Chargeback Protection is available for accounts enrolled in Advanced Credit and Debit Card Payments.

16Available for eligible transactions. Limits apply.

17Available on eligible purchases.

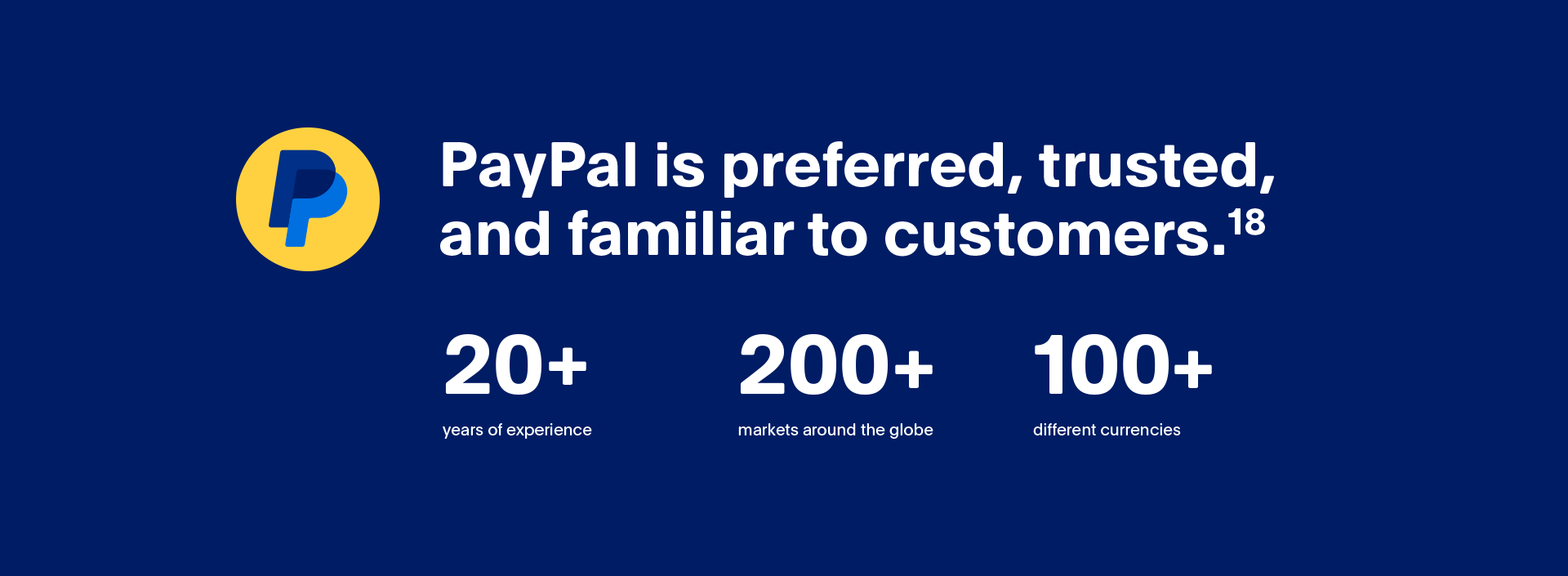

18Morning Consult - The 15 Most Trusted Brands Globally. March 2021. Morning Consult surveyed over 330,000 consumers across 10 international markets to provide a global view on the current state of consumer trust across brands

19Our standard rate pricing listed herein is for US transactions only in USD and is effective starting on August 2, 2021.

20Chargeback Protection is available starting on August 2, 2021 on eligible advanced credit and debit card payments and excludes guest transactions (Additional limits apply). Merchants need to opt in for Chargeback Protection through their PayPal business account to activate this feature. May be subject to additional fees. Merchants who do not manage their own PayPal business account, due to your platform’s integration with PayPal, do not have access to Chargeback Protection at this time.

21PayPal Digital Payments include payment methods such as PayPal, Pay Later options including Pay in 4 and Pay Monthly, Venmo, Pay with Rewards, and Checkout with Crypto.

22Credit and Debit Card present transactions will be charged at a rate of 2.29% + $0.09 per transaction. Credit and Debit Card keyed transactions will be charged at a rate of 3.49% + $0.09 per transaction. QR Code transactions using PayPal Zettle Services will be charged at a rate of 2.29% + $0.09 per transaction.

23In-person PayPal and Venmo QR Code transactions above $10 will be processed at a rate of 1.90% and $0.10; transactions $10 and below will be processed at a rate of 2.40% + $0.05.